Louisiana Loses Another Insurer, Leaving More Homeowners in a Bind

LOUISIANA (KPEL News) - Policies for about 36,000 property owners won't be renewed next year after a Florida-based company prepares to pull out of Louisiana and several other states.

United Property & Casualty (UPC) is the latest in a long list of insurers who are pulling out of the state amid an increasing financial crisis for insurance companies in the south. There was no reason for the move in the company's announcement, but their financial ratings were downgraded in August, according to multiple reports.

The move impacts 33,000 residents right now, and another 3,000 will be able to renew before the new year, but will not be able to again.

Louisiana Citizens insurance, meanwhile, was approved for a major premium increase by the Louisiana Department of Insurance earlier this year. Louisiana Citizens is backed by the state, and is the insurance of last resort for many residents in the state.

According to NOLA.com, there are nearly two dozen companies leaving the state.

The company had the fifth-largest share of Louisiana’s home insurance market in 2021, at a little more than 3%, or $65.3 million in premiums. Southern Fidelity, which failed earlier this year, actually had more policyholders, but the value of the property it insured was less.

UPC’s exit adds to a growing list of at least 23 companies that have recently withdrawn from Louisiana or gone insolvent. Altogether, the group held more than 200,000 policies, nearly a fifth of the state’s market.

What's Going On?

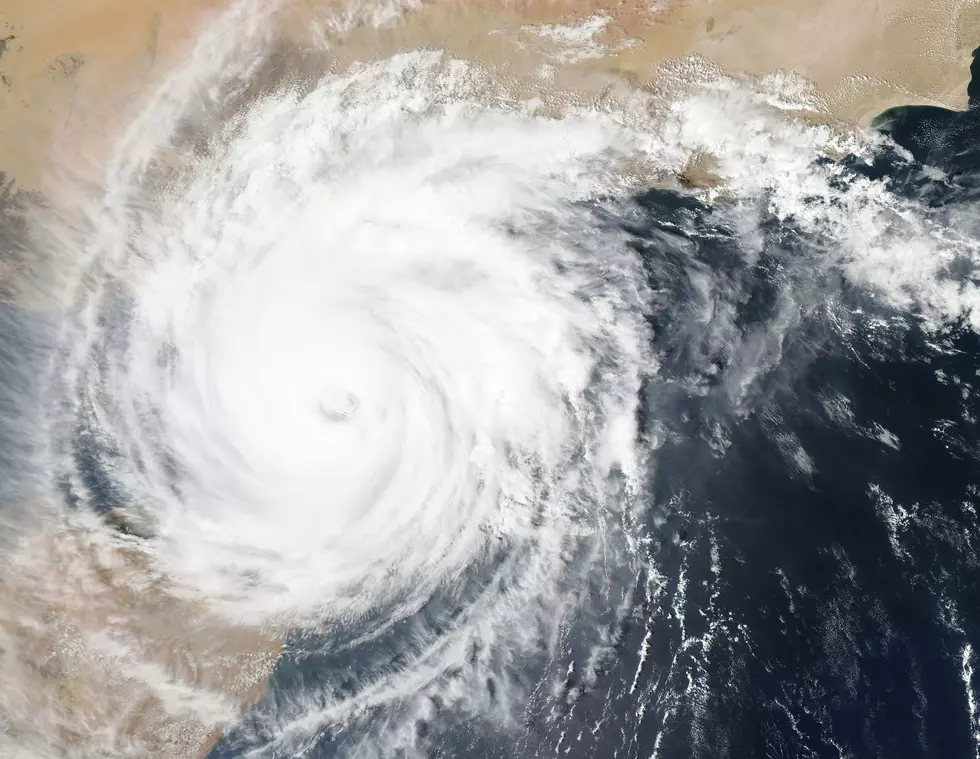

In Louisiana, it's become increasingly difficult to purchase an affordable homeowner's policy if you live below I-10 - the region of the state that is heavily hit by hurricanes year after year (the unusually quite 2022 season notwithstanding).

Louisiana Insurance Commissioner Jim Donelon told KPEL News in September that several insurance companies will "no longer insure people whose property sits below I-10 and I-12."

The state has seen so many storms in the last few years that many companies simply would not take the chance to insure properties. When those companies refused to write those policies anymore, the only option left for people was Louisiana Citizens.

Donelon was ultimately the person who had to sign the 63 percent premium for Louisiana Citizens. According to state law, Citizens has to push its rate higher than the market rate in order to push customers to find their insurance elsewhere.

Donelon has also attempted to use financial incentives to bring some of the firms back to Louisiana.

LOOK: 25 over-the-top Christmas displays from across America

LOOK: The top holiday toys from the year you were born

More From Hot 107.9

![Empty Gallon of Milk Could Come In Handy If Electricity Goes Out [PHOTO]](http://townsquare.media/site/34/files/2021/08/attachment-GettyImages-1257995328.jpg?w=980&q=75)